Card Review: AMEX Marriott Bonvoy Brilliant Card [June 2022 Update]

Marriott underwent an extensive merger with Starwood Preferred Guest (SPG) and re-branded its loyalty program to Marriott Bonvoy in Summer 2019. A byproduct of this merger was a restructure of the Bonvoy program and its credit cards. Currently, Chase and American Express (AMEX) are the two institutions that offer Marriott co-branded cards. While Chase focuses on zero to low annual fee cards for entry-level members, AMEX offers more premium options for loyalists. The Marriott Bonvoy Brilliant by American Express has the highest annual fee in the entire Marriott co-branded portfolio (excluding discontinued offerings such as the Ritz Carlton Card), but comes with great benefits that will easily offset the costs.

Marriott offers both traditional and unique options for all types of travelers, and the AMEX Marriott Bonvoy Brilliant can get you closer to experiencing its amazing properties. Photo by Marriott.

Sign-Up Bonus & Multipliers

The Marriott Bonvoy Brilliant currently offers a sign-up bonus of 75,000 Marriott Bonvoy points when you spend $3,000 within your first 3 months of card membership. Keep in mind that in order to be eligible for the signup bonus, you need to follow AMEX’s Once-In-A-Lifetime rule, meaning you can only earn each card bonus once per lifetime. This rule is especially important for Bonvoy Brilliant due to the Marriott-SPG merger; account holders of the now-discontinued SPG Luxury Card, also offered by AMEX, are not eligible for the signup bonus. Using the valuation of 0.8 cents per point, the welcome bonus of 75,000 Bonvoy points is worth about $600.

The Marriott Bonvoy Brilliant card comes with great benefits that can substantially offset its annual fee.

The card earns 6X Marriott Bonvoy points per dollar when you book directly with Marriott, 3X points on dining and flights booked directly with airlines, and 2X on all other purchases. Paired with Marriott’s promotions and AMEX offers, it opens doors to endless points-earning opportunities.

If you’d like to apply for the American Express Bonvoy Brilliant Card, please consider using my referral link. It will continue to help fund my blog operations and help visitors make informed decisions to maximize their rewards. Thank you! http://refer.amex.us/EDWARSMaWs?xl=cp19&mpt=v0

Annual Fee & Benefits

The annual fee of the AMEX Marriott Bonvoy Brilliant card is $450, which makes the card a Tier 4 card on my credit card totem pole. The card comes with many useful benefits that effectively offset the annual fee. Since I don’t encourage churning and always promote healthy strategies and decisions when it comes to applying, I always ask if the value out of a card justifies keeping it for years based on my lifestyle. Even with the high annual fee, the Bonvoy Brilliant will stay in my wallet for a long time due to its great benefits and perks.

$300 in Statement Credits

Every cardmember year, primary cardholders receive up to $300 in statement credits for any Marriott-related purchase. These include room rates, room service, and even gift cards. If you travel at least once a year, you should be able to use this credit. Even if you aren’t able to travel, you can always buy a gift card since they never expire. Because of the versatility of the credit, I value it at 100%, lowering the effective annual fee from $450 to $150. However, this benefit will be ending on September 22, 2022, and will be replaced with a monthly credit of $25 each month in statement credits. The monthly dining credit can be used globally at restaurants, and if you successfully utilize the dining credit every month for a year, the savings would equate to $300.

The $300 statement credit offered by the Bonvoy Brilliant can even be used towards room service!

If you already used your $300 credit at Marriott properties, you will still qualify for $25 in monthly dining credits, starting immediately in October 2022.

Free Night Certificate

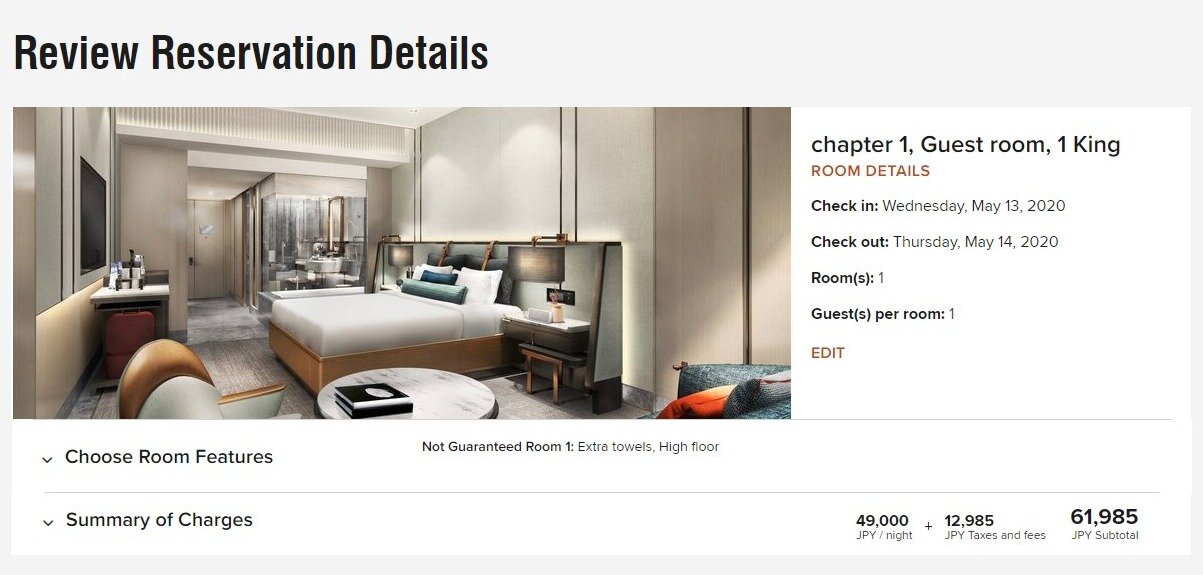

Upon renewal and every year thereafter, cardholders get a free night certificate. You can use this certificate to stay at any domestic or international Marriott property worth up to 50,000 Bonvoy points per night. If you wish to stay at hotels that cost more than 50,000 points, you can add up to additional 15,000 points to experience more upscale hotels. You can score incredible deals when you use this certificate overseas. For instance, staying a night at MESM Tokyo, Autograph Collection would usually cost a visitor about 61,985 Japanese Yen, equivalent to $576.52 USD. The same night can be redeemed using the free night certificate since the rewards redemption rate is 50,000 Bonvoy points.

Booking a room at MESM Tokyo, Autograph Collection will cost about 61,985 Japanese Yen, equal to $576.52 USD… Photo by Marriott.

…Or Bonvoy Brilliant cardholders can simply apply their free night certificate! Photo by Marriott.

Domestic travel can still earn amazing redemption rates; the Westin Bonaventure Hotel & Suites, Los Angeles is a great example. If you were to redeem the free night certificate, you can save $724.53, almost five times the card’s effective annual fee of $150. You might even be able to justify keeping the card for the free night certificate alone!

Booking a room at the Westin Bonaventure Hotel & Suites in LA could cost you more than $700 USD… Photo by Marriott.

…Or you could pocket that cash and redeem your free night certificate. Photo by Marriott.

Automatic Gold Elite Status

Cardholders who sign up for the Bonvoy Brilliant will automatically receive Marriott Gold Elite status. Spending $75,000 or more on the card in a calendar year will elevate this to Platinum Elite status, though I personally don’t think this is worth going out of the way to pursue. Gold Elite will earn you 25% more Bonvoy points on direct Marriott spending and allow you to enjoy late check-out and potentially upgraded rooms, excluding suites. Unfortunately, Gold Elite members do not qualify for other beneficial perks such as free breakfast and lounge access which only Platinum Elites and above can access. It’s also important to note that only primary cardholders receive automatic Gold Elite status while authorized users are excluded from this benefit.

15 Elite Night Credits

The elite night credit can be a beneficial perk for Bonvoy Brilliant cardmembers chasing a status higher than the default Gold Elite. Cardmembers will automatically earn 15 elite qualifying nights, meaning they only need to stay 35 nights at Marriott properties to be qualified as Platinum Elite. As mentioned above, this status tier unlocks notable benefits including suite upgrades, free breakfast, and executive lounge access. As of right now, Marriott status can be earned after spending the following qualifying nights in one of their properties:

Silver Elite - 10 nights

Gold Elite - 25 nights

Platinum Elite - 50 nights

Titanium Elite - 75 nights

Ambassador - 100 nights + $20,000 annual qualifying spend at Marriott properties

If you want to learn more about Marriott’s elite levels, take a look at their chart here.

With the right status and some luck, you may get upgraded to stay at over-water villas in a Pacific island!

Complimentary Priority Pass Membership

As with almost all premium travel cards, the AMEX Bonvoy Brilliant provides Priority Pass Lounge access. This means you can visit more than 1,200 airport Priority Pass lounges around the world. Priority Pass lounges offer basic food and beverages and are especially useful for travelers hoping to enjoy a few drinks before their flights.

Up to $100 Towards Incidentals Credit

In order to use this benefit, your stay must involve at least two nights at select Ritz-Carlton or St. Regis properties, and the stay paid with your Bonvoy Brilliant. $100 incidental credits can be used for room service or spa treatments, but it won’t stretch too far at these luxury accommodations.

Looking for a luxury staycation? Use the $100 towards a spa treatment at your closest Ritz-Carlton!

Reimbursed Application Fees for either Global Entry or TSA PreCheck

This is another staple credit for premium travel cards. Cardmembers can get up to $100 in statement credit when the Bonvoy Brilliant is used to pay for the application. I would highly suggest using this benefit for a Global Entry application since it includes TSA PreCheck. Global Entry can save you hours of waiting time in line over a year if you often travel internationally. You can use this credit every 4 years and apply it to a friend or family member if your own Global Entry membership is covered by another card.

Skip the line using Global Entry! It will save you time and money at airports to escape those dastardly TSA lines.

Summary

Although its secondary benefits are more targeted toward Marriott loyalists, the American Express Marriott Bonvoy Brilliant still makes sense for most people. The two primary benefits, a free night certificate and a $300 Marriott/dining credit, will yield more returns than the card’s annual fee of $450. If you’re a Marriott loyalist, secondary benefits such as 15 elite nights can be extremely helpful towards achieving the next tier in their elite status structure. The Marriott Bonvoy Brilliant from American Express is a quintessential example of a keeper card due to its perks outweighing and easily offsetting the annual fee. I personally believe the card deserves a permanent spot in everyone’s wallet and strongly recommend applying for its incredible perks and benefits.

If you’d like to apply for the American Express Bonvoy Brilliant Card, please consider using my referral link. It will continue to help fund my blog operations and help visitors make informed decisions to maximize their rewards. Thank you! http://refer.amex.us/EDWARSMaWs?xl=cp19&mpt=v0

![Card Review: AMEX Marriott Bonvoy Brilliant Card [June 2022 Update]](https://images.squarespace-cdn.com/content/v1/5e155597124c2c0cab493f6e/1656016601537-FNYPT63CZOISE1H8V6FO/AMEX%2BMarriott%2BBonvoy%2BBrilliant_PointsMiler.jpeg)

![Credit Card Review: AMEX Marriott Bonvoy Business [August 2022 Update]](https://images.squarespace-cdn.com/content/v1/5e155597124c2c0cab493f6e/1650926397955-CNJ5WWFB782TCH1BBE8W/IMG_3805%252B2.jpg)