Credit Card Review: Revamped AMEX Marriott Bonvoy Brilliant

As travel is slowly going back to the pre-COVID-19 level, American Express (AMEX) recently revamped the AMEX Marriott Bonvoy Brilliant card. It has been one of my keeper cards because of its annual Free Night Award (worth up to 50,000 points) and the $300 hotel credit. Moreover, it would give me an extra 15 Elite Night Credits, fast-forwarding my yearly requalification toward Titanium Elite status. The revamp entirely restructured the card; the benefits became more substantial, and unfortunately, the annual fee also increased. Will the AMEX Marriott Bonvoy Brilliant card continue to be one of my workhorse cards? Let’s find out!

The AMEX Marriott Bonvoy Brilliant card has a fresh new design and benefits. Photo by AMEX.

Sign-Up Bonus & Multiplier: Worth up to $1,200

The Marriott Bonvoy Brilliant currently offers a sign-up bonus of 150,000 Marriott Bonvoy points when you spend $5,000 within your first three months of card membership. Remember that to be eligible for the signup bonus, you need to follow AMEX’s Once-In-A-Lifetime rule, meaning you can only earn each card bonus once per lifetime. Using the valuation of 0.8 cents per point, the welcome bonus of 150,000 points is worth about $1,200.

The AMEX Marriott Bonvoy Brilliant card comes with a great sign-up bonus. Photo by AMEX.

The card earns 6X Marriott Bonvoy points per dollar when you book directly with Marriott, 3X points at restaurants globally and flights booked directly with airlines and 2X on all other purchases. Paired with Marriott’s promotions and AMEX offers, it opens doors to endless points-earning opportunities.

If you’d like to apply for the American Express Bonvoy Brilliant Card, please consider using my referral link. It will continue to help fund my blog operations and help visitors make informed decisions to maximize their rewards. Thank you!

Annual Fee & Benefits

The new annual fee of the AMEX Marriott Bonvoy Brilliant card is $650, which makes the card a Tier 4 card on my credit card totem pole. Although the annual fee is raised by $200 from the previous $450 price tag, the card’s benefits have been upgraded to offset the annual fee effectively. Even with the increased annual fee, the AMEX Marriott Bonvoy Brilliant card will stay in my wallet for a long time due to its great benefits and perks.

$25 Monthly Dining Credit in Statement Credits—$300 Total

Previously, primary cardholders of the AMEX Marriott Bonvoy card received up to $300 in statement credits for any Marriott-related purchase every cardmember year. These include room rates, room service, and even gift cards. Now, the benefit is replaced with a monthly dining credit of $25 in statement credits, and the monthly dining credit can be used globally at restaurants. If you successfully utilize the dining credit every month for a year, the savings would equate to $300, effectively lowering the annual fee from $650 to $350. I enjoy the versatility of the credit because if you dine out at least once a month, you should be able to utilize the entire credit.

The monthly $25 dining credit works globally so take your AMEX Marriott Bonvoy Brilliant card the next time when you travel!

Free Night Award—Up to 85.000 Points

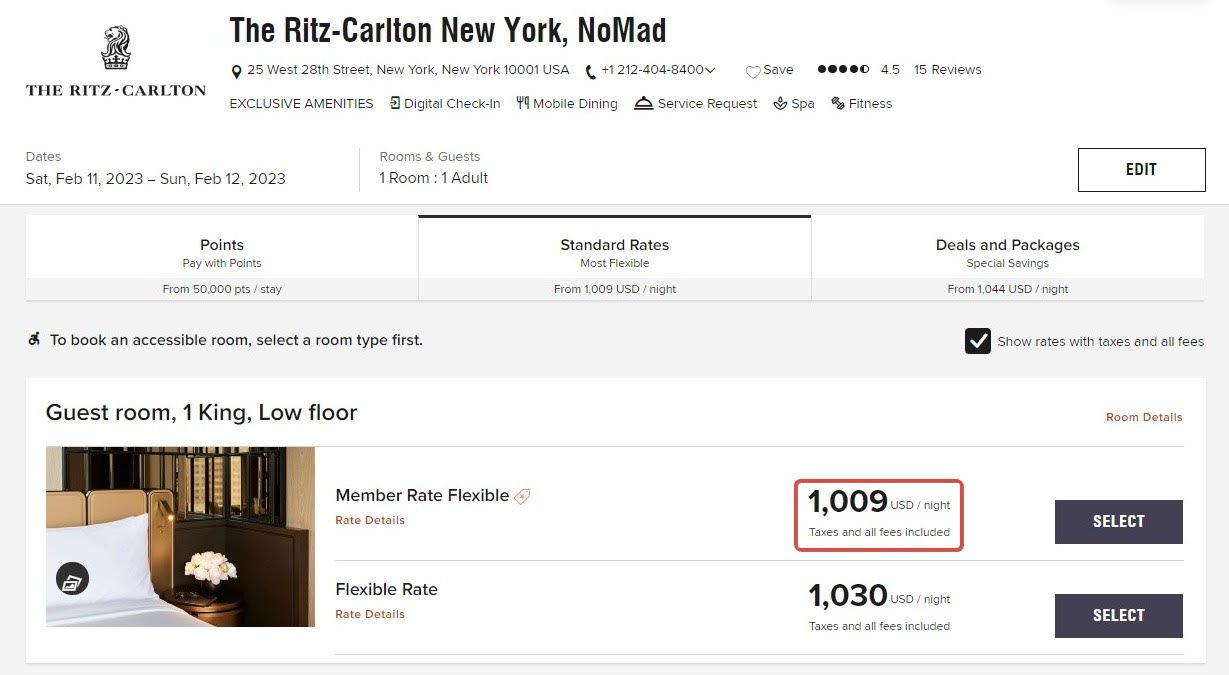

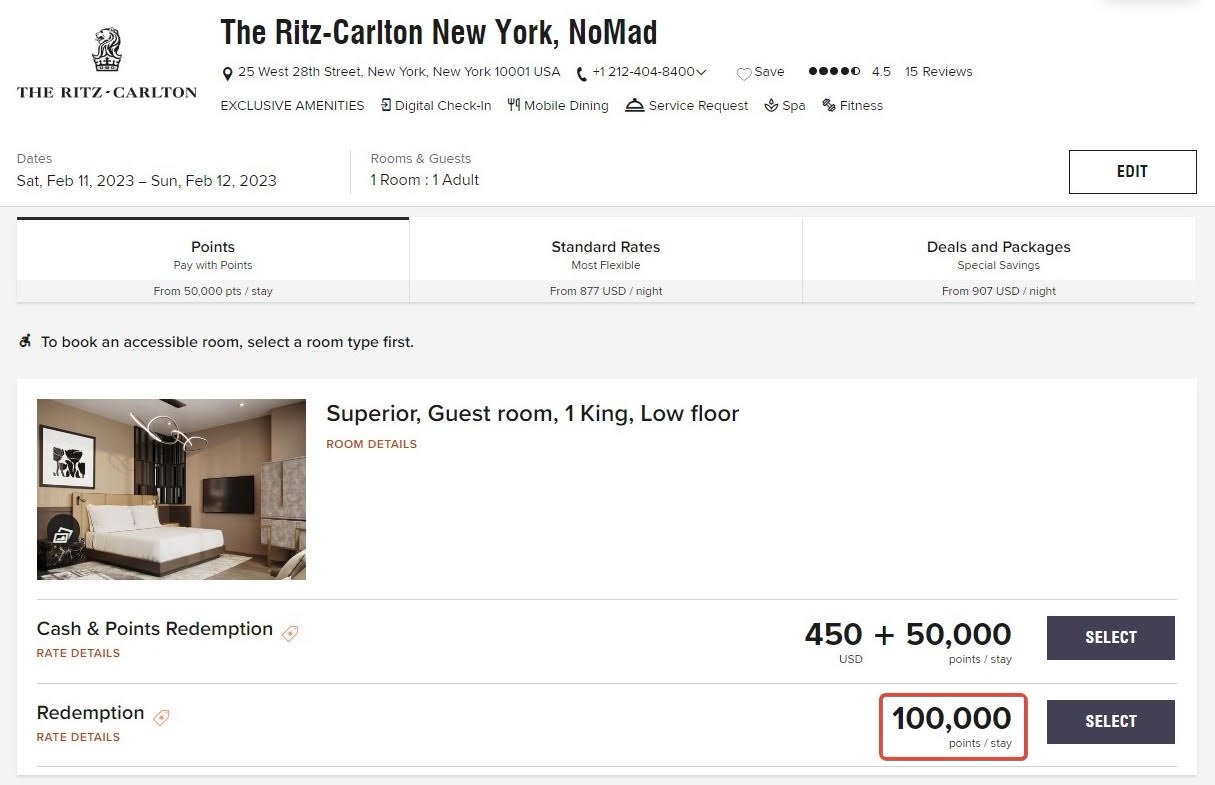

Upon renewal and every year thereafter, cardholders get a Free Night Award. Previously, the annual Free Night Award was redeemable at properties worth up to 50,000 points per night. However, it is now redeemable at hotels that cost up to 85,000 points per night. Since you can top it off with up to 15,000 points, you can stay at top-of-the-line hotels with the 100,000 points nightly price tag if you have points to spare. The annual Free Night Award can be redeemed at any domestic or international Marriott property, and the increase in the Award’s value opens new doors for Marriott customers. For instance, staying at The Ritz-Carlton New York, Nomad, the cash rate is over $1,000 a night; believe it or not, that is one of the lowest rates I found.

Instead, you can combine 15,000 points and the annual Free Night Award and enjoy a complimentary stay at The Ritz-Carlton New York, Nomad. If you don’t have extra points lying around, you can still stay at amazing hotels with the Award alone. Take a look at Price de Galles, a Luxury Collection Hotel, Paris—a grand, art deco hotel in Paris.

The cash rate I found for the hotel is roughly $850 a night, but usually, it hovers around $1,200 a night. Your romantic night in Paris is completely covered with the Free Night Award from the AMEX Marriott Bonvoy Brilliant card.

Automatic Platinum Elite Status

Cardholders of the AMEX Marriott Bonvoy Brilliant card formerly enjoyed complimentary Gold Elite status, and now cardmembers will receive automatic Platinum Elite status. Platinum Elite status is the middle tier on the Marriott Bonvoy elite status ladder and the most noticeable perks are complimentary access to lounges and free breakfast. In addition, Platinum Elites receive 50% bonus points on stays and can choose Annual Choice Benefit after earning 50 Elite Night Credits. It’s also important to note that only primary cardholders receive automatic Platinum Elite status while authorized users are excluded from this benefit.

In addition to these benefits, Platinum Elites receive free breakfast and complimentary access to executive lounges. Photo by Marriott.

25 Elite Night Credits

By holding the AMEX Marriott Bonvoy Brilliant card, cardmembers will automatically earn 25 elite qualifying nights. The next Elite status level is Titanium Elite, and you would need additional 50 nights at Marriott properties to be qualified as Titanium Elite. Unless you are a road warrior, I don’t think spending an extra 50 nights just to qualify for Titanium Elite status is worth your time and money because the Platinum Elite level already provides practical benefits such as complimentary breakfast and free executive lounge access.

The difference between Gold Elite and Platinum Elite is quite significant. Photo by Marriott.

If you want to learn more about Marriott’s elite levels, take a look at their chart here.

Earned Choice Award—After Spending $60,000

Starting 1/1/2023, when you spend $60,000 using your AMEX Marriott Bonvoy Brilliant card every calendar year, you can receive one of the following as Earned Choice Award: five Suite Night Awards, $750 off a bed from Marriott Bonvoy Boutiques, or a Free Night Award with a redemption value up to 85,000 points. I could see either five Suite Night Awards or a Free Night Award being potentially useful, but with the card’s mediocre multipliers, I don’t recommend putting $60,000 on the card exclusively to receive Earned Choice Award.

Complimentary Priority Pass Membership

As with almost all premium travel cards, the AMEX Bonvoy Brilliant card comes with Priority Pass Lounge access, which means you can visit more than 1,200 airport Priority Pass lounges worldwide. Priority Pass lounges offer basic food and beverages and are especially useful for travelers hoping to enjoy a few drinks before their flights.

When you have a layover in Frankfurt, stop by at the Lufthansa Senator Lounge for free with your Priority Pass membership.

Up to $100 Incidental Credits at St. Regis and The Ritz-Carlton

When staying at least two nights at select The Ritz-Carlton or St. Regis properties, you can enjoy up to $100 incidental credit if you pay for the stay with your AMEX Marriott Bonvoy Brilliant card. The incidental credits can be used for room service or spa treatments, but remember that any service at these luxury accommodations will be fairly expensive.

How about enjoying afternoon tea at St. Regis Toronto with your $100 incidental credit?

Reimbursed Fees for either Global Entry or TSA PreCheck Application

Cardmembers can get up to $100 in statement credit when their AMEX Marriott Bonvoy Brilliant card is used to pay for either Global Entry or TSA PreCheck application. I would highly suggest using this benefit for a Global Entry application since it includes TSA PreCheck. If you often travel internationally, Global Entry can save you hours of waiting time in line. The application fee reimbursement benefit can be used every four years, and if your own Global Entry membership is covered by another premium travel credit card, either your friend or family member can utilize your benefit.

Summary

The new AMEX Marriott Bonvoy Brilliant card is finally here. The card now comes with an annual Free Night Award worth up to 85,000 points, and cardmembers receive an automatic Platinum Elite status. Moreover, the $300 Marriott credit has been converted to a monthly $25 credit. However, the AMEX Marriott Bonvoy Brilliant now carries a hefty annual price tag of $650, and I am not sure if many people can justify the increase in the annual fee. The AMEX Marriott Bonvoy Brilliant card is now similarly priced to the AMEX Platinum card, which may return more value for average consumers. Because of my loyalty to the Marriott brand, the AMEX Marriott Bonvoy Brilliant card will live in my wallet for a while, and I’m interested to see how many people will renew their upgraded AMEX Marriott Bonvoy Brillian cards.

If you’d like to apply for the American Express Bonvoy Brilliant Card, please consider using my referral link. It will continue to help fund my blog operations and help visitors make informed decisions to maximize their rewards. Thank you!

![Credit Card Review: AMEX Marriott Bonvoy Business [August 2022 Update]](https://images.squarespace-cdn.com/content/v1/5e155597124c2c0cab493f6e/1650926397955-CNJ5WWFB782TCH1BBE8W/IMG_3805%252B2.jpg)